- Regulator will launch market study examining position of Amazon, Microsoft and Google in UK’s £15bn cloud services market

- If competition concerns are identified it could lead to further action

- Ofcom also kicks off work to look at digital services such as WhatsApp, Zoom and smart speakers, as online and traditional networks converge

Ofcom is to examine the position of Amazon, Microsoft and Google in cloud services, as part of a new programme of work to ensure that digital communications markets are working well for people and businesses in the UK.

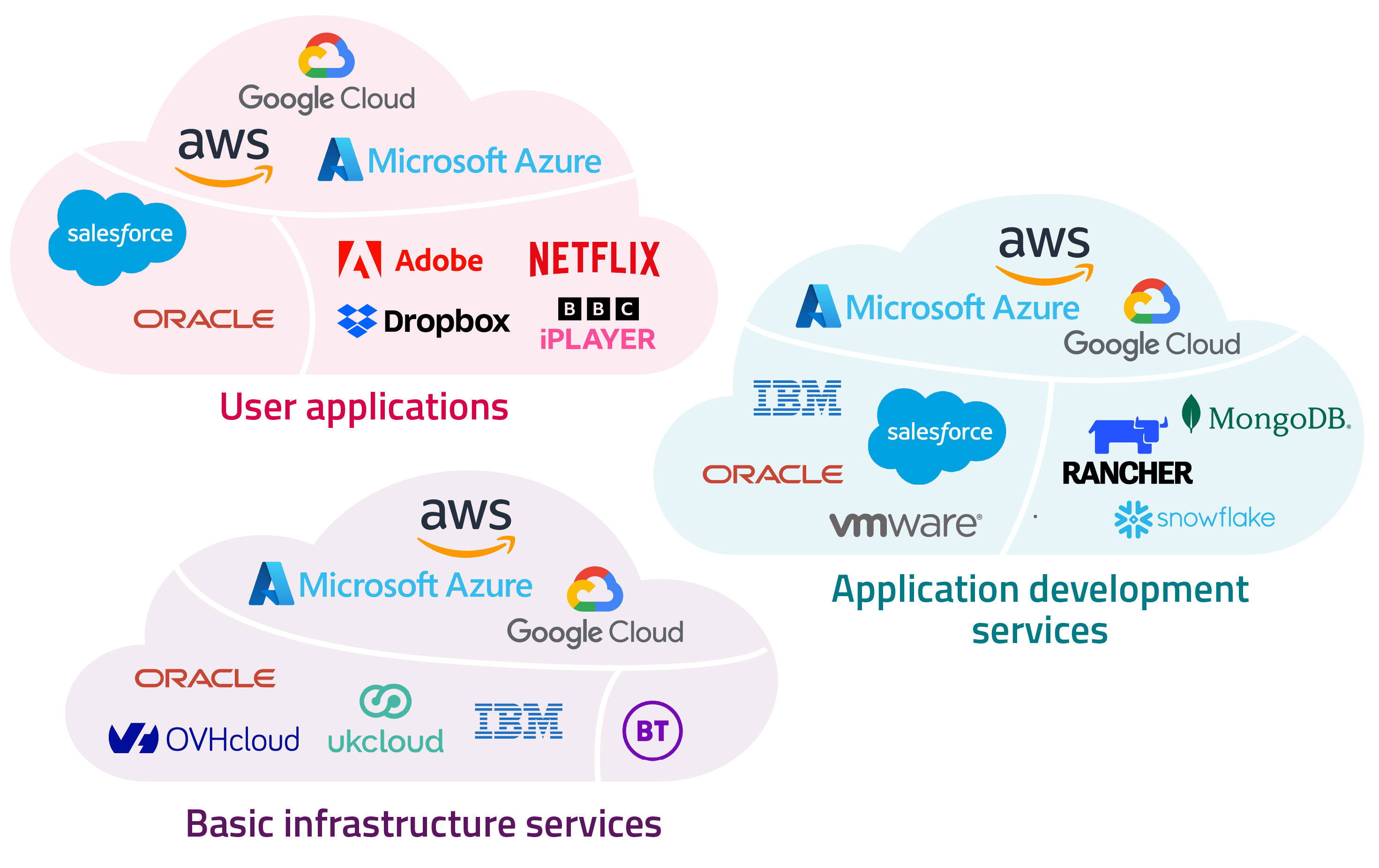

Cloud computing is a huge and fast-growing market[1], which uses remote servers to offer services such as software, storage and computing power. The user, who could be a person or business, makes use of these services but doesn’t manage them directly. The cloud has become an essential part of how products are delivered to telecoms users, as well as viewers and listeners of TV, radio and audio content.

In the coming weeks, Ofcom will launch a market study[2] under the Enterprise Act 2002 into the UK’s cloud sector. The largest providers of cloud services – known as ‘hyperscalers’ – are Amazon Web Services (AWS), Microsoft and Google. Collectively, these three firms generate around 81% of revenues in the UK public cloud infrastructure services market.

Our study will formally assess how well this market is working. We will examine the strength of competition in cloud services generally and the position the three hyperscalers hold in the market. We will also consider any market features that might limit innovation and growth in this sector by making it difficult for other companies to enter the market and expand their share.

Because the cloud sector is still evolving, we will look at how the market is working today and how we expect it to develop in the future – aiming to identify any potential competition concerns early to prevent them becoming embedded as the market matures.

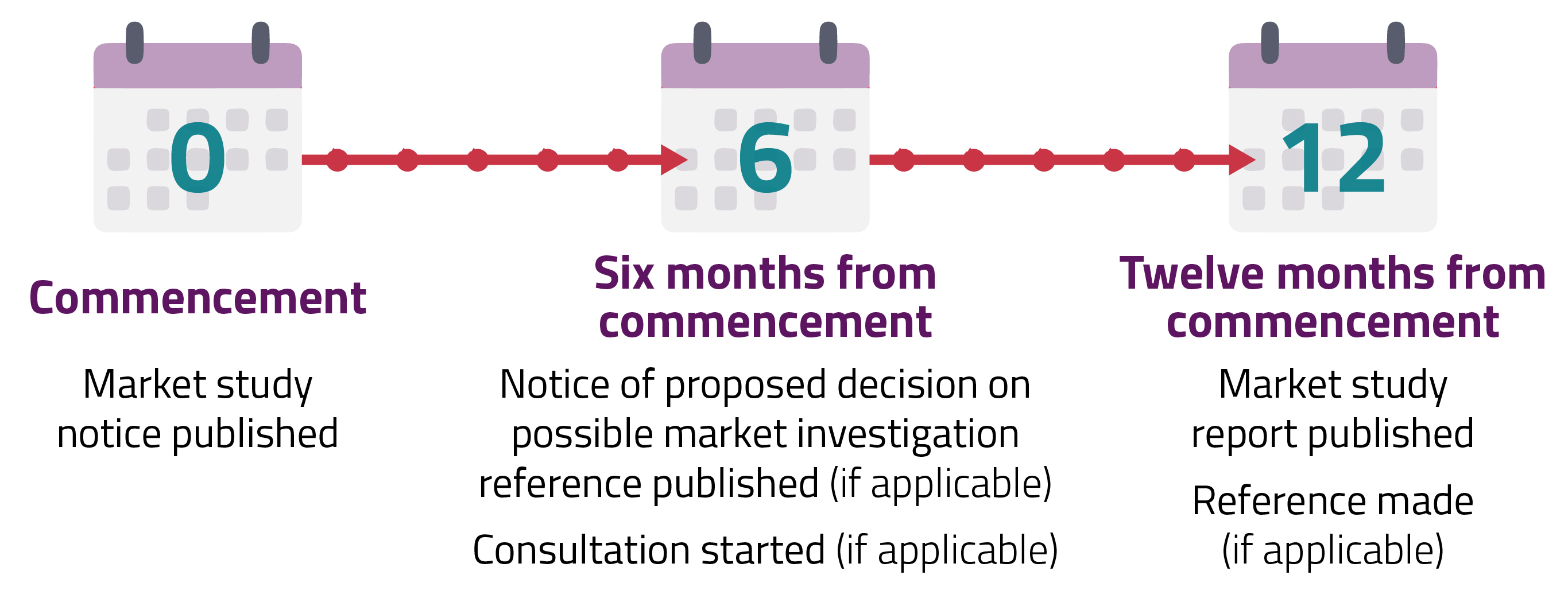

When we launch the market study, we will invite initial views on the UK cloud market from interested or affected parties. We plan to consult on our interim findings and publish a final report – including any concerns or proposed recommendations – within twelve months.

If we find a market is not working well, there can be negative impacts on businesses and ultimately consumers, through higher prices, lower service quality and reduced innovation. In these circumstances, Ofcom can take one or more of the following steps:

- make recommendations to government to change regulations or policy;

- take competition or consumer enforcement action;

- make a market investigation reference to the Competition and Markets Authority (CMA);

- accept undertakings in lieu of making a market investigation reference.

We have engaged closely with the CMA in planning the market study, and will continue to do so during the course of the project. Ofcom will lead the market study, drawing on our strong expertise in communications markets and reflecting that cloud is increasingly becoming an important element of the infrastructure of the internet.

WhatsApp, Zoom and smart speakers

Over the next year, Ofcom will also start a broader programme of work to examine other digital markets, including online personal communication apps and devices for accessing audiovisual content.

We are interested in how services such as WhatsApp, FaceTime and Zoom are affecting the role of traditional calling and messaging, and how competition and innovation in these markets may evolve over the coming years. We also want to understand whether any limitations on their ability to interact with each other raises potential concerns.

Another future area of focus for Ofcom is the nature and intensity of competition among digital personal assistants and audiovisual ‘gateways’ – such as connected televisions and smart speakers – through which people access traditional TV and radio, as well as online content.

We will explore competition dynamics in this sector and identify whether there are any potential areas that require more formal examination. Our work will include analysis of consumer behaviour, future developments, as well as the role and business models of major players and their bargaining power with content providers.

The way we live, work, play and do business has been transformed by digital services. But as the number of platforms, devices and networks that serve up content continues to grow, so do the technological and economic issues confronting regulators.

That’s why we’re kick-starting a programme of work to scrutinise these digital markets, identify any competition concerns and make sure they’re working well for people and businesses who rely on them.

Selina Chadha, Ofcom's Director of Connectivity

Why Ofcom is examining these markets

As the sector regulator, and with our powers to explore potential competition issues under the Enterprise Act, Ofcom’s job is to make sure that communications markets are working well for consumers and businesses. That includes keeping pace with disruptive developments in our sectors – such as new and emerging technologies, or changes in commercial models and supply chains.

Services like WhatsApp or Zoom, provided by internet-based firms working across the value chain, are competing with traditional telecoms services. Smart TVs and smart speakers now play a central role in how content is distributed and discovered.

But digital innovations also create a risk of new types of harm. So, starting with cloud services, Ofcom is taking a closer look at these sectors, in line with our duty to promote competition for the benefit of communications consumers.

Notes to editors

- In 2018, less than 10% of all businesses’ global IT spending was for public cloud services. This rose sharply to reach 17% last year, as the Covid-19 pandemic increased the need for remote working. Some analysts expect 45% of businesses’ IT spend to be on public cloud by 2026 (see: Gartner Says Four Trends Are Shaping the Future of Public Cloud).

- Market studies are examinations into the causes of why particular markets may not be working well in the interests of consumers. We are carrying out the cloud market study using our powers as a competition authority under the Enterprise Act 2002.