- Nearly 43 million UK adult internet users have encountered suspected scams online

- Among victims who lost money, one in five were left over £1,000 out of pocket

- Majority of online users think tech firms have responsibility to act to tackle problem

Around nine in ten online adults in the UK (87%) have come across content they suspected to be a scam or fraud, new research commissioned by Ofcom reveals.

Nearly half of the participants in the study (46%) said they had been personally drawn in by an online scam, while two in five (39%) knew someone else who had fallen victim.

A quarter of those who said they’d encountered online scams had lost money as a result (25%) - with a fifth (21%) being scammed out of £1,000 or more.

More than a third (34%) of all victims also reported that the experience had an immediate negative impact on their mental health, increasing to nearly two-thirds (63%) among those who had lost money.

Online scams and fraud – the personal cost

Today’s report[1] is one of a series of research studies to help inform our preparations for implementing new online safety laws.

Building on our experience and understanding of tackling telecoms scams, the study explores people’s experiences of online fraud, including the practical and emotional impact. The research finds, among other things, that:

- Men (89%), younger adults aged 18-34 (92%) and people with children in the household (93%) are significantly more likely than average (87%) to say they have encountered online content that they suspected to be a scam or fraudulent;

- Among those who had experienced an online scam or fraud, nearly a quarter (23%) first encountered it on social media - the second most common channel after email. (30%).[2]

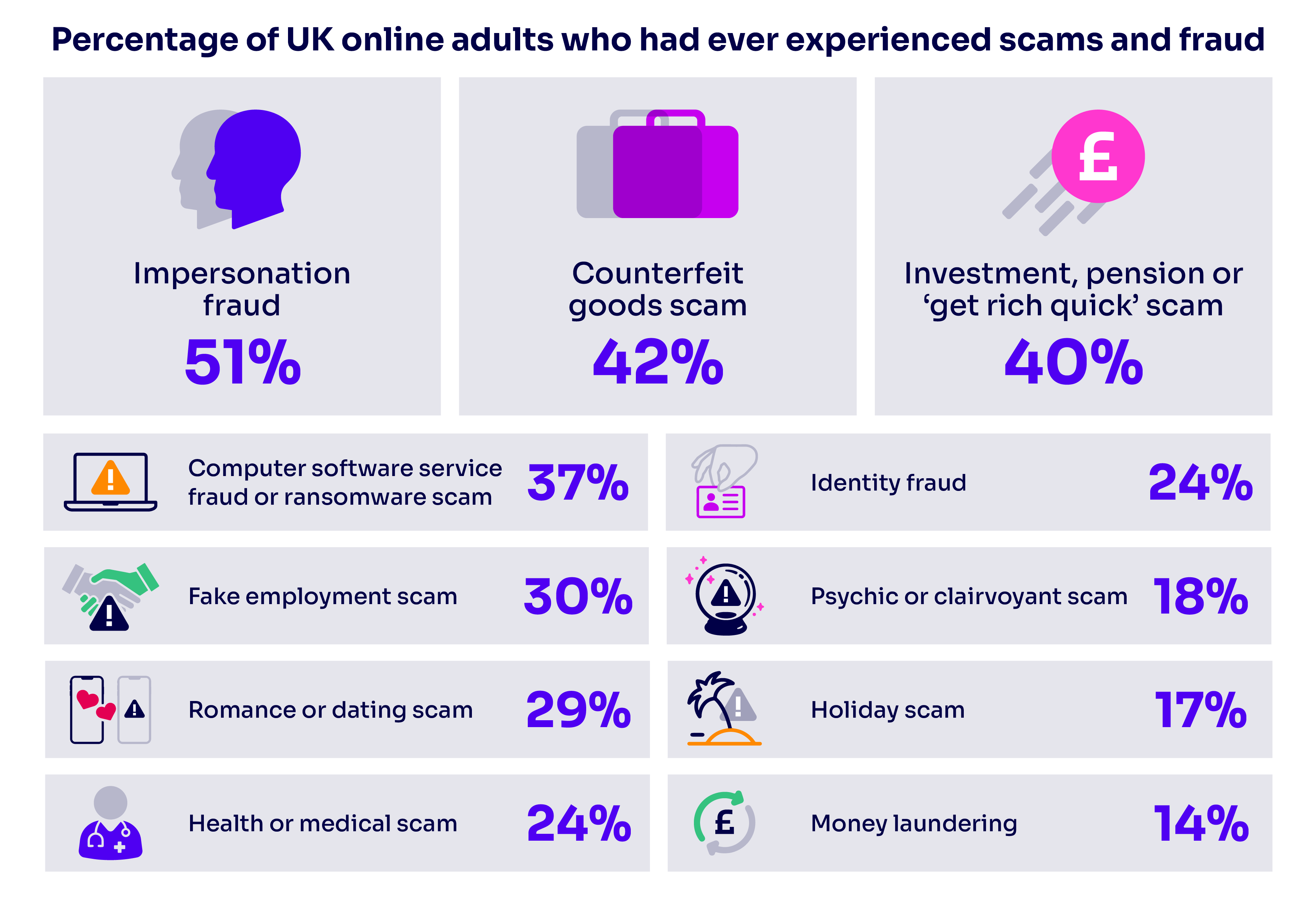

- Impersonation fraud (51%) was the most common type experienced, followed by counterfeit goods scams (42%), investment, pension or ‘get rich quick’ scams (40%) and computer software service or ransomware scams (37%).[3]

- Potential victims were most commonly contacted via a direct message, or a mass message posted to a group (46%). A fifth were reached through online advertisements (20%), while others were targeted through user-generated and influencer posts or videos (6% and 4% respectively).

- Among those who suffered financial loss from any type of scam, two in five (42%) lost between £1 and £99, while one in five (21%) lost £1,000 or more. Those who encounter counterfeit goods scams were most likely to have lost money (40%).

- A significant minority (17%) of those who experienced a potential scam or fraud online didn’t take any action at all. Of these, most thought that their report wouldn’t be acted upon or make a difference, or they didn’t know who to inform (29% respectively).

Tackling online fraud and scams

When asked who should take action against online scams and fraud[4], the majority of participants (61%) felt online tech firms have a responsibility. Fewer people – just over half – said responsibility should fall to users, or to the police (54% respectively), while three in ten (30%) think Ofcom should be responsible.

The majority of participants (53%) considered that an online alert from the platform, warning that the content or messages had come from an unverified user, would be useful in helping to prevent people falling victim to scammers.

Under the Online Safety Bill, which is currently making its way through Parliament, tech firms in scope of the new regulation[5] will be required to assess and take steps to mitigate the risks of harm to users from ‘priority illegal content’. This will include certain types of fraudulent content. They’ll also have to take steps to mitigate the risk of the platform being used to commit or facilitate fraud.

Larger online services will also have to use systems and processes designed to prevent individuals from encountering fraudulent adverts, and take them down when they become aware of them.

Ofcom will have new powers to ensure platforms comply with their new online safety duties, and will develop Guidance and Codes of Practice to assist their compliance.

Richard Wronka, Ofcom Director, Online Safety Policy, said: “Falling victim to online fraud can have a devastating impact on people’s financial and mental well-being.

“The Online Safety Bill will place new obligations on online services to protect their users against online fraud and scams. Today’s report provides crucial evidence that will help to inform our approach to implementing those new laws when they arrive.”

Head to our news centre for some top tips on protecting yourself against the scammers.

Notes to Editors

- The Online Scams and Fraud Research was carried out by Yonder Consulting on Ofcom’s behalf. It constitutes a mixed-method quantitative and qualitative study, conducted with a sample of internet users aged 18+ in the UK. The quantitative phase was conducted via an online survey which took place between 5th and 17th May 2022, among a sample of 2,097 UK residents. The qualitative phase ran from 12th October to 11th November 2022, consisting of online in-depth interviews with 32 victims of online scams or fraud (to explore their experiences and the resultant impact on their lives in greater detail), and 5 online in-depth interviews with experts who support victims of online scams and fraud.

- Email services and emails are not in scope of regulation under the Online Safety Bill

- Impersonation fraud: Fraudsters pretend to be from a legitimate organisation (e.g. a financial institution, the NHS, lottery institution, solicitors, government officials) and request a payment or information from you.

Counterfeit goods scam: Counterfeit goods (e.g. fake designer brand clothes, accessories, perfumes, pirated copies of DVDs and computer games), often found at auctions and web marketplaces, where you can’t check if the products are genuine until the item has been delivered.

Investment, pension or ‘get rich quick’ scam: Fraudsters often present themselves as a trustworthy institution or advisor to pressurise you to invest money, or by luring with returns that are too good/quick to be true. They may present legitimate sounding investment opportunities such as energy firms, the foreign exchange market, or cryptocurrencies.

Computer software service fraud or ransomware scam: Fraudsters use computer techniques to disable your computer’s normal functioning, sometimes unknowingly to you, to steal your money or personal information. - Participants could choose multiple options from a list which included the platform/service itself; Action Fraud; the police; Ofcom; Financial Conduct Authority; Advertising Standards Authority; users themselves; and the bank/credit card company.

- The new online safety laws will apply to ‘user-to-user services’ - meaning services that enable users to share content with each other, as well as search services