While mobile phone calls are still a popular way to keep in touch with friends and family, most adults would rather go without them for a day than forgo their favourite messaging apps if they had to choose between them, according to new research published by Ofcom.

Online communication services like WhatsApp and Snapchat have become increasingly important to our daily lives. So, Ofcom has been taking a closer look at how people use them outside of work, how they affect the role of traditional telecoms services, and how these markets may evolve in future.

Keeping in touch

Online communication services (OCS) are in many cases valued more highly by consumers than traditional telecoms services, such as text messaging or phone calls.

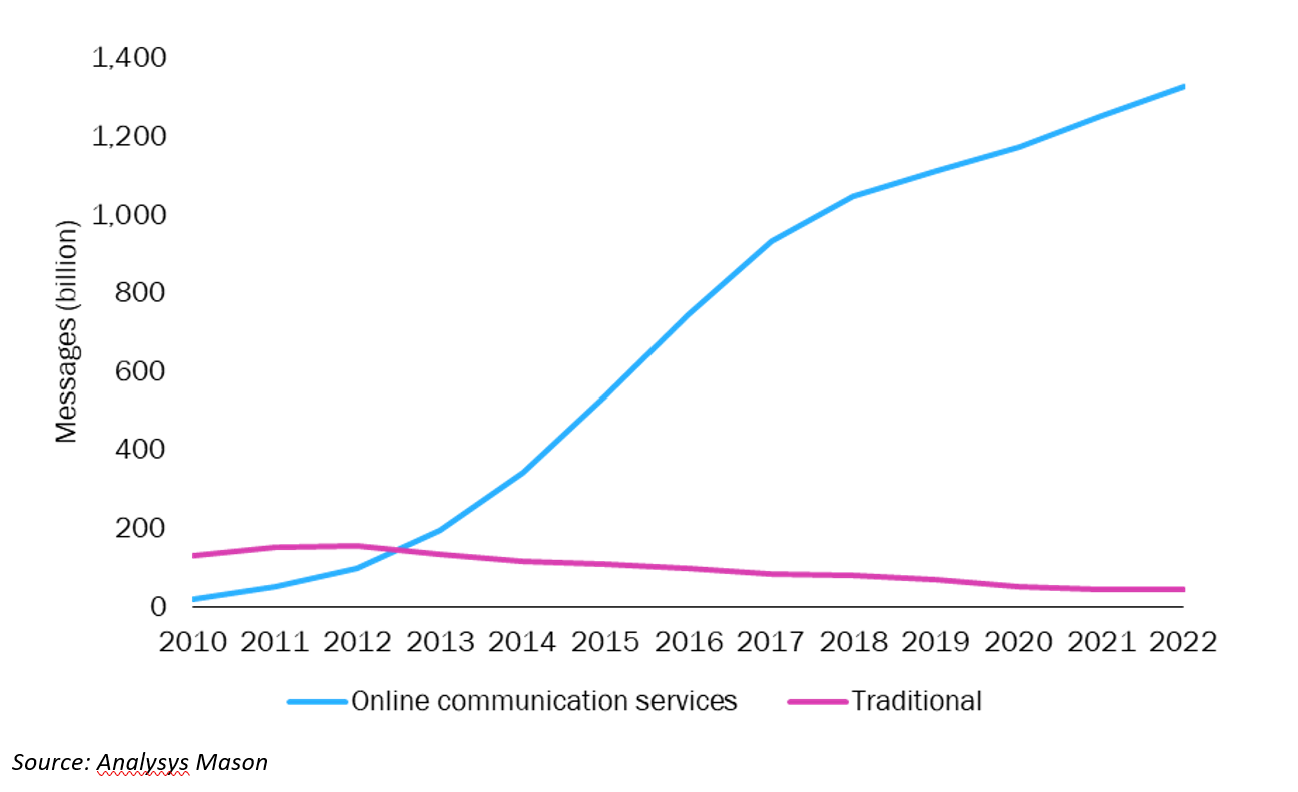

According to Ofcom’s latest research, between 2012 and 2022, the number of text messages (SMS and MMS) sent fell from 151 billion to 36 billion.[1] Over the same period, the number of online messages sent in the UK has increased from 100 billion a year to over 1.3 trillion.

Person-to-person messaging volumes in the UK by traditional and online communication services

Mobile phone calls are still a popular way to keep in touch with friends and family. Between 2012 and 2022, the amount of time we spent making mobile phone calls increased from 132 billion minutes to 170 billion minutes, and 83% of UK adults have made a mobile call in the last three months.

However, only a quarter (26%) of those people made a mobile phone call on a daily basis, and even fewer (23%) sent a traditional text message every day. In comparison, two thirds (67%) of people who use an online communications service do so daily.

Around three in five UK adults (58%) say they would rather go without mobile phone calls for 24 hours than go without their favourite messaging apps.[2]

WhatsApp is particularly popular

Many people use a number of online communication services at the same time, with the average UK adult actively using three different services over the last three months.

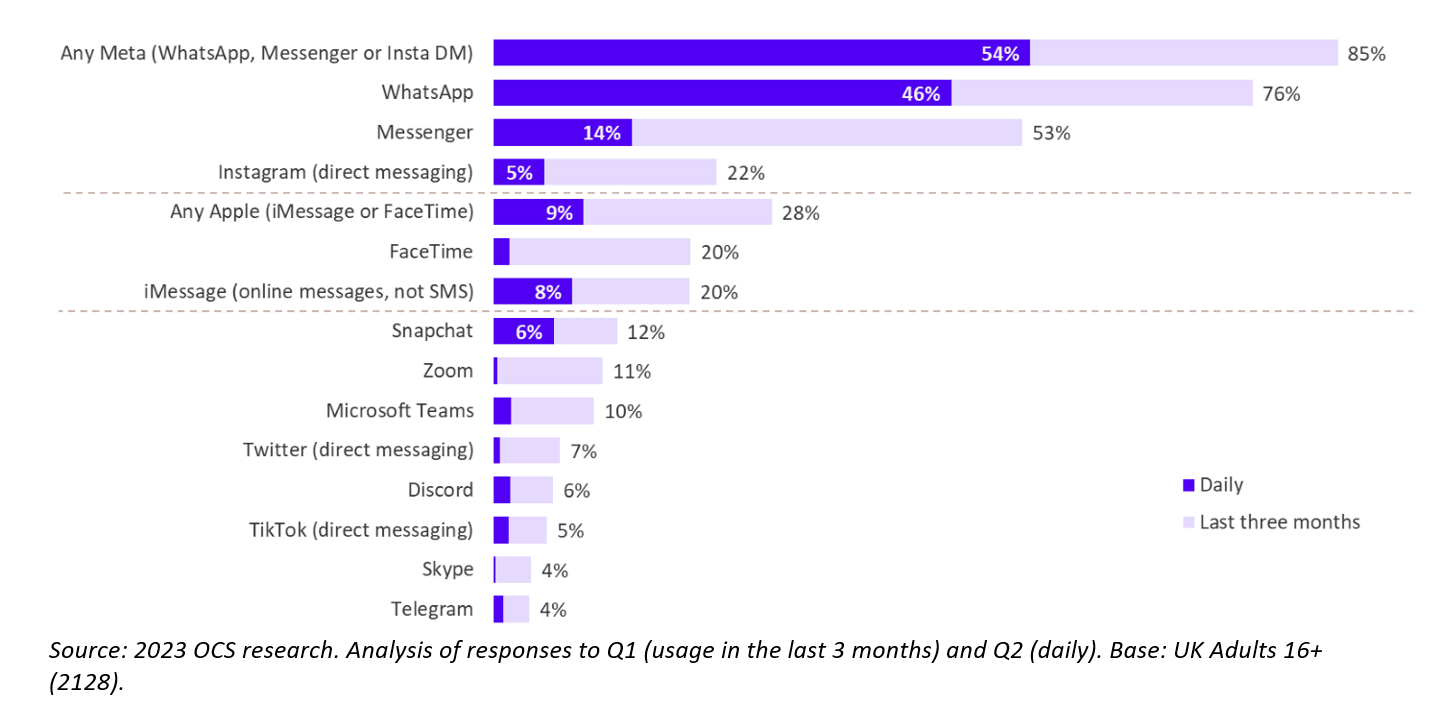

However, WhatsApp is the most commonly-used messaging app in the UK, with 76% of adults using it in the last three months. Around two thirds of UK adults (65%) say that WhatsApp is their main online communication service, followed by Messenger (18%) and iMessage (6%).

Usage of services for personal messaging or calling purposes Only one in 10 have changed which messaging app they use the most in the past year, with around half of those (51%) doing so because of its popularity among their friends and family.

Only one in 10 have changed which messaging app they use the most in the past year, with around half of those (51%) doing so because of its popularity among their friends and family.

Online communication services are also popular for all age groups with 81% of internet users over 65s using these services and 76% of over 55s using these services at least weekly.

Competition and consumer protection observations

The usefulness of any messaging app depends on whether a person’s friends or relatives are also using that app. This can give larger platforms an advantage, acting as a barrier to entry and expansion for newer or smaller platforms who may struggle to attract users. We found that WhatsApp, and Meta's online communication services as a whole, hold a strong competitive position.

However, this effect is mitigated to some degree by tendencies to use a number of these apps at the same time, particularly among younger users. So far, we have seen broadly positive outcomes for users[3] with little evidence of significant harm from competition issues at this point in time. But features and monetisation strategies are evolving, which could affect competition in the future.

From a consumer protection perspective, the main areas of risk we have identified relate to the misuse of messaging apps by scammers and fraudsters, and the sharing of illegal or harmful content. These issues will be covered by the forthcoming online safety regime and are out of scope for this work.

We will continue to monitor developments in the sector, in case new concerns arise in the future as features, usage and business models continue to evolve.

Footnotes:

[1] Source: Ofcom Communications Market Report 2023.

[2] YouGov surveyed 2,128 UK adults online in March 2023. Figures have been weighted and are representative of all UK adults (aged 16+).

[3] Consumers can access a wide range of services, which are usually provided free of charge; and users rate their services positively.