- Broadcast TV’s weekly audience reach sees steepest annual decline since records began, while older audiences’ daily viewing drops at fastest rate ever

- Number of TV programmes pulling in 4m+ viewers halves since 2014, but public service broadcasters still dominate most-watched list with valued national TV moments

- Teens and young adults spend an hour a day on TikTok, with ‘snackable’ short-form content particularly popular

- Commercial radio riding a wave in its 50th year, while smart speakers and podcasts see growth in use

The media diets of viewers and listeners in the UK appear to be more diverse and fragmented than ever, according to Ofcom’s latest annual report on the TV, online video, radio and audio sectors.

As competition for the nation’s attention intensifies, Media Nations 2023 finds that the proportion of viewers who tune in to traditional broadcast TV each week has seen the sharpest ever annual fall – from 83% in 2021 to 79% in 2022.[1] BBC One remains the only channel to reach more than half of the viewing population every week.[2]

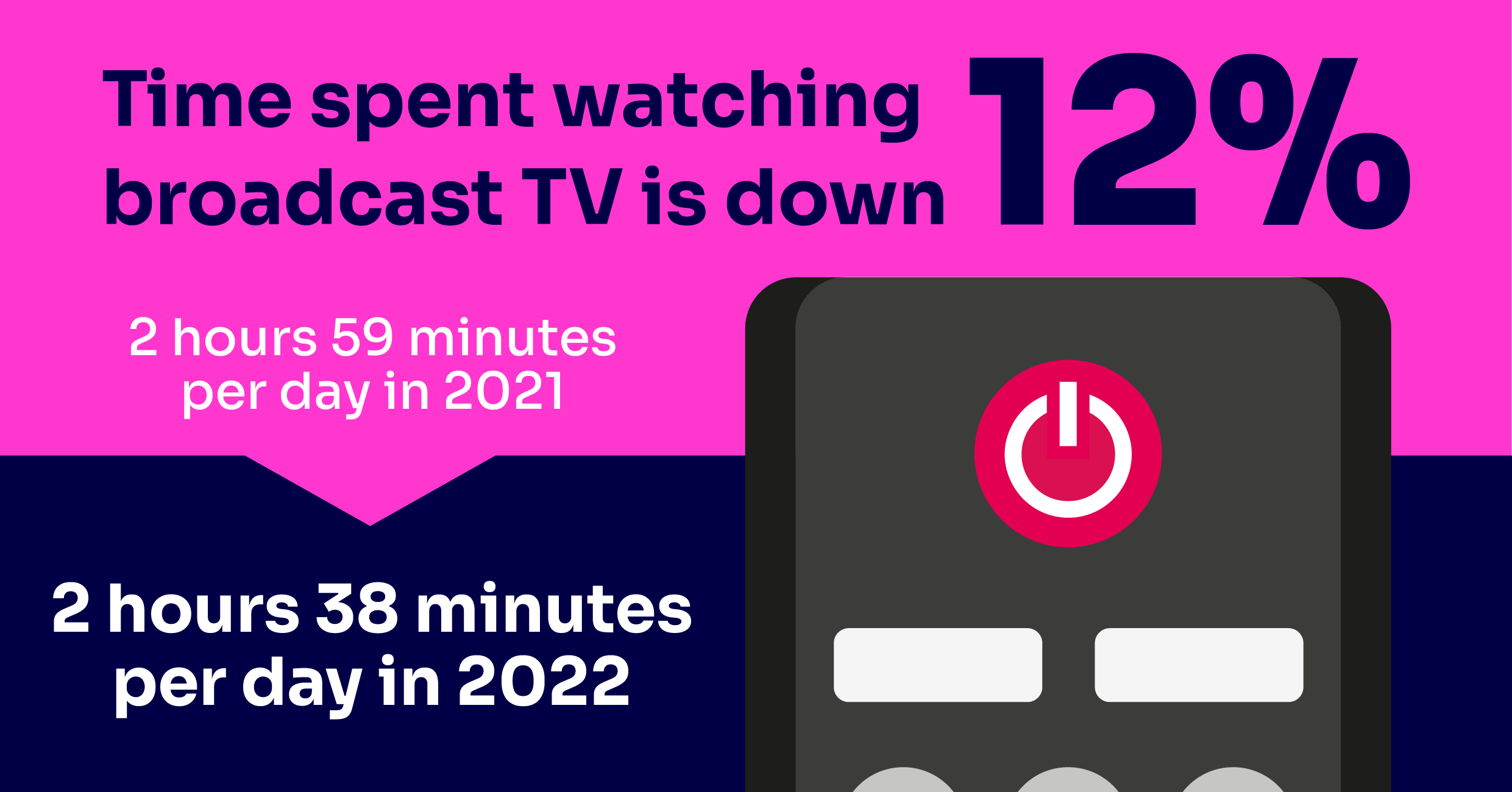

A similar decline is evident in the average time that viewers spend watching broadcast TV each day – down from 2 hours 59 minutes in 2021, to 2 hours 38 minutes in 2022 (-12%). For the first time, there is evidence of a significant decline in average daily broadcast TV viewing among ‘core’ older audiences (aged 65+) – a drop of 8% year on year, and down 6% on pre-pandemic levels.[3]

A similar decline is evident in the average time that viewers spend watching broadcast TV each day – down from 2 hours 59 minutes in 2021, to 2 hours 38 minutes in 2022 (-12%). For the first time, there is evidence of a significant decline in average daily broadcast TV viewing among ‘core’ older audiences (aged 65+) – a drop of 8% year on year, and down 6% on pre-pandemic levels.[3]

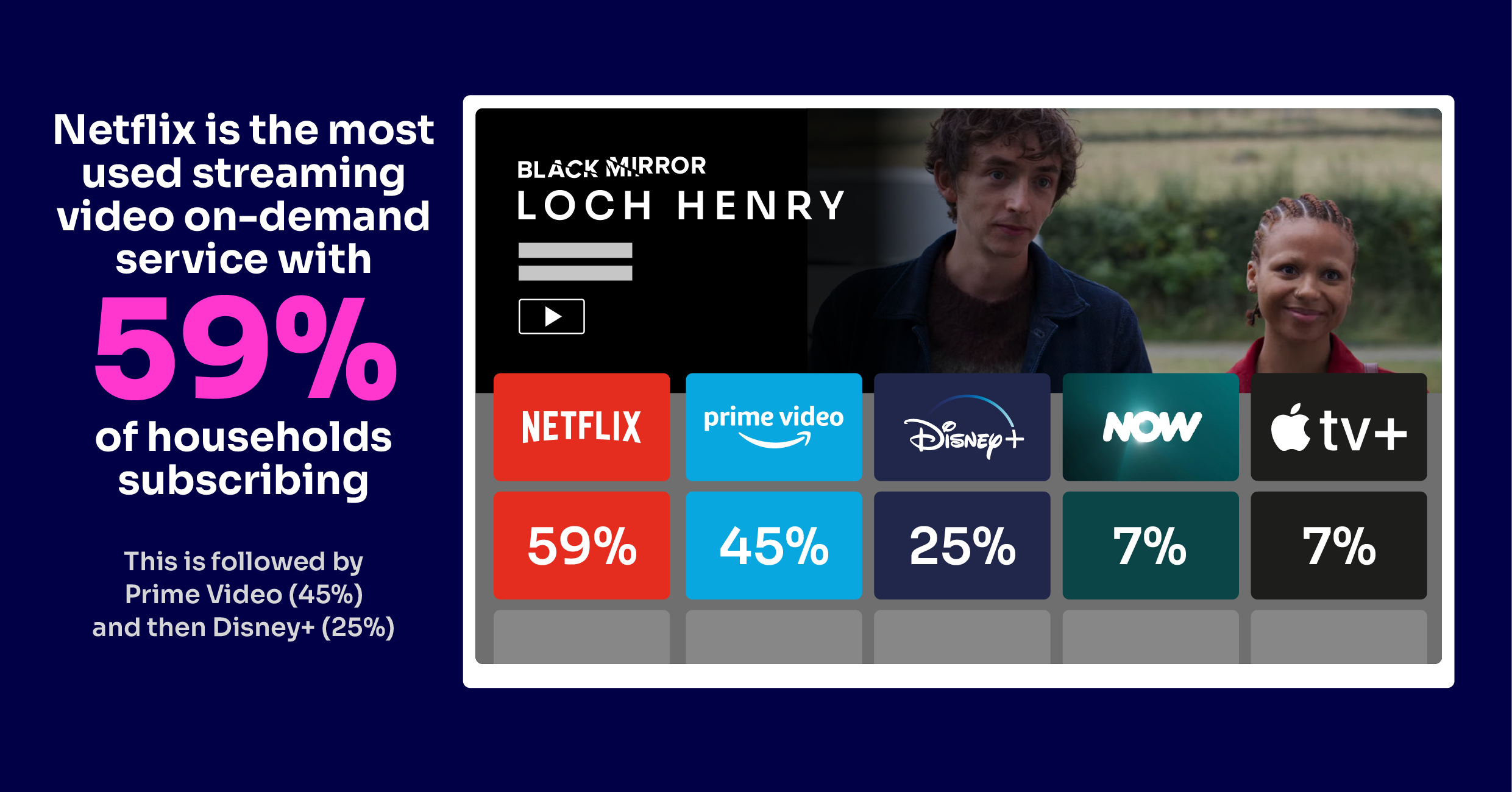

Our data also suggests that older viewers are diversifying their viewing and becoming more likely to take up streaming services, although household take-up of these services overall appears to be plateauing.[4] The proportion of over-64s subscribing to Disney+, for example, increased from 7% in 2022 to 12% in 2023.

Steep decline in ‘mass audience’ programmes

The report reveals another notable shift in the broadcast TV landscape – a steep decline in the number of programmes attracting ‘mass audiences’. The number of programmes with more than four million TV viewers has halved over the past eight years, from 2,490 in 2014, to 1,184 in 2022.[5]

While the number of programmes with large audiences is down across all genres, these declines are a reflection of fewer people watching the main early and late evening TV news bulletins, as well as a steady decline in viewing figures for the three most popular soaps: Coronation Street, EastEnders and Emmerdale. Since 2014, news programmes attracting 4m+ viewers are down 72% – from 537 to 148 programmes, while mass audience soap episodes are down 42%, from 754 to 438 programmes.

In comparison, only 48 programmes averaged more than four million TV viewers on streaming platforms in 2022, with Netflix accounting for the vast majority. High levels of viewing to these services are spread across the tens of thousands of episodes available in their libraries, illustrating just how fragmented the viewing landscape has become.

Public service broadcasters succeed in bringing the nation together

Despite the continuing decline of traditional broadcast TV viewing, BBC One (20%) and ITV1 (13%) are still the top two first destinations for viewers when they turn on their TV, with Netflix coming in third (6%). In addition, watching broadcasters’ content - either live, on recorded playback or streamed on-demand – still accounts for the greatest proportion of all time spent each day watching TV and video (60%, 2 hours 41 minutes per person, per day).

With broadcasters digitalising their services to meet audiences’ changing needs, use of their video-on-demand services, such as BBC iPlayer and ITVX, continues to grow. ITVX accounted for 10% of ITV’s total viewing in the first half of 2023, up from 7% across 2022. BBC iPlayer rose from 14% of the BBC’s total viewing to 18% during the same time period.

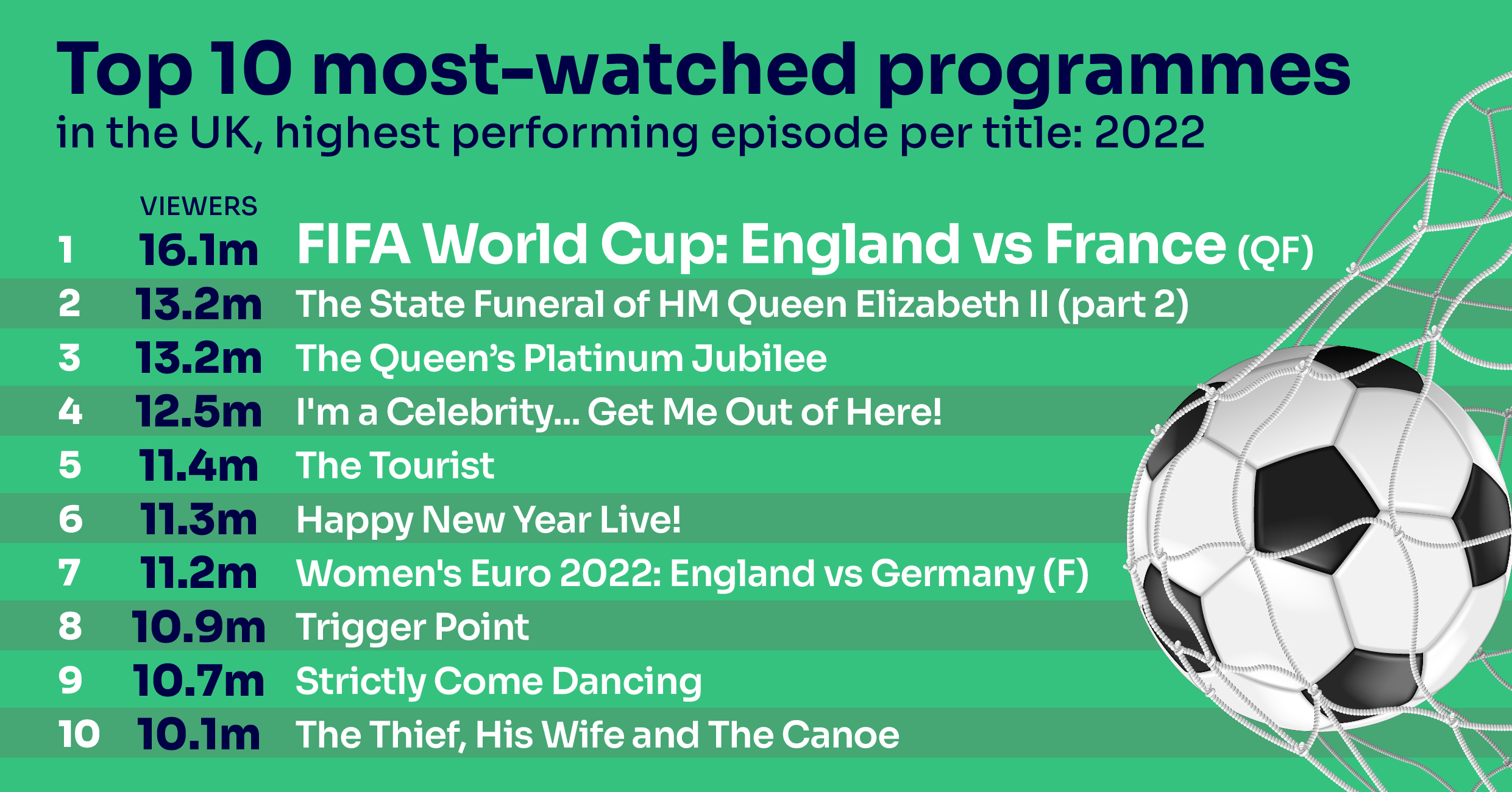

Public perception of the public service broadcast channels remains positive, with seven in ten viewers (69%) saying they were satisfied with them overall. Viewers also recognised the contribution of these channels in delivering ‘broadcast events that bring the nation together for a shared viewing experience’ – with sentiment increasing from 61% in 2021 to 65% in 2022. PSBs’ programmes of this nature dominated the list of most-watched programmes in 2022, with England’s quarter-final in the FIFA World Cup (16.1m viewers), HM Queen Elizabeth II’s state funeral (13.2m viewers), and the Platinum Jubilee (13.2m viewers) holding the top spots.[6]

In 2022, the PSBs were able to return to full production schedules. As a result, PSB spend on first-run original programmes totalled £2.9bn, up 10.3% year on year, and 14.2% greater than in 2019, while hours broadcast climbed to their highest point since 2016 – totalling 32,712.

Teenage and young adult users of TikTok clock up an hour a day on the platform

Children and young adults under 25 have collectively decreased their average daily broadcast viewing by 73% since 2012. For the first time, 16-24-year-olds watched less broadcast TV on average than children aged 4-15 (39 minutes per day compared to 41). Evidence suggests they’re tuning in for only one or two programmes per day, mainly for genres such as sport and popular entertainment or reality programming.

Social video platforms remain a major part of youngsters’ daily media habits. In March 2023, 5.2 million 15-24-year-olds visited TikTok, spending an average of 58 minutes per day on the platform. This was followed by Snapchat (52 minutes), YouTube (48 minutes) and Instagram (25 minutes).

‘Snackable’ short-form video content lasting less than 10 minutes is particularly popular. Nearly seven in ten (68%) 15-24s claim to watch short-from videos daily, with YouTube the most popular destination for this kind of content.

Commercial radio riding a wave in its 50th year

Live radio continues to reach the majority of adults across the UK, with 88% of people tuning in for an average of 20 hours each week across digital, analogue and online platforms. This listening has previously been split more or less equally between BBC and commercial radio stations, but over the past year, commercial radio consolidated its position as market leader to take a 51.4% share in Q1 2023 – five percentage points clear of the BBC.

Radio listening continues to shift to online, with smart speakers now accounting for a fifth of in-home radio listening (20%). A fifth of adults’ audio listening is to streamed music (21%), although this increases to 50% among 15-34s.

Around one in five adults (20%) listen to podcasts each week, with the increase largely driven by listeners aged 25-44. Older teens and younger adults, however, appear to be turning away from podcasts, with weekly listening among 15-24s falling to just under 22% in Q1 2023.[7]

Today’s viewers and listeners have an ‘all-you-can-eat’ buffet of broadcasting and online content to choose from, and there’s more competition for our attention than ever.

Our traditional broadcasters are seeing steep declines in viewing to their scheduled, live programmes – including among typically loyal older audiences – and soaps and news programmes don’t have the mass-audience pulling power they once had.

But despite this, public service broadcasters are still unrivalled in bringing the nation together at important cultural and sporting moments, while their on-demand players are seeing positive growth as they digitalise their services to meet audience needs.

– Yih-Choung Teh, Group Director, Strategy and Research at Ofcom

Visit our news centre for the top media industry trends including revenues, advertising and more.

Notes to editors

- The figures quoted for broadcast TV are for 28-day consolidated viewing on a TV set. Consolidated viewing includes viewing of programmes at the time they were broadcast (live viewing) as well as from recordings on digital video recorders (DVRs) and through online broadcaster video-on-demand (BVoD) services (e.g. BBC iPlayer, ITVX and Sky Go/Sky TV On Demand) up to 28 days after the first broadcast (time-shifted).

Weekly reach is defined as the percentage of all individuals aged 4+ watching 15 consecutive minutes or more in an average week.

The largest declines in weekly reach have been among 16-24s (from 82% in 2017 to 54% in 2022, with a six-percentage-point decrease last year), and children aged 4-15 (from 87% in 2017 to 60% in 2022, down five percentage points year on year). - Although BBC One continues to have the highest weekly reach of all TV channels (58%), this is 12 percentage points lower than in 2017.

- Before the pandemic, broadcast TV viewing among the 64+ age group was generally stable.

- Two-thirds (66%) of UK households reported using a subscription video-on-demand service in Q1 2023, down from a peak of 68% in Q1 2022.

- There was an even sharper drop (82%) in the number of broadcast transmissions generating more than six million TV viewers, from 1,172 in 2014 to 213 in 2022.

- Top ten most-watched programmes in the UK, highest performing episode per title: 2022

- Figures for reach of radio, average hours, share of radio listening on smart speakers and reach of podcasts relate to RAJAR Q1 2023. These were the most recent at time of writing. RAJAR data for Q2 2023 will be released on Thursday 3 August.