Today we’ve published our latest research looking at the media habits and preferences of people across the UK.

The headline findings show rapid change in how the UK’s viewers and listeners make use of TV, online video, radio and audio. But there are further findings that shine a light on how people across the country access and enjoy a range of content across an increasingly diverse set of media and platforms.

The full findings are available in our Media Nations report, but we’ve selected a few highlights here.

Big national moments were what we watched most on TV

While we identified a decline in the number of programmes attracting mass audiences, with the number of programmes attracting more than four million TV viewers halving over the past eight years, major moments of national interest brought us together in front of our TV screens. The list of most-watched programmes in 2022 was dominated by sporting and royal events – England’s quarter-final against France in the FIFA World Cup topped the table with an average of 16.1 million viewers.

The second part of BBC One’s coverage of the state funeral of HM Queen Elizabeth II was watched by an average of 13.2 million viewers and The Queen’s Platinum Jubilee averaged slightly fewer.

Top 10 most-watched programmes in the UK, 2022 (highest performing episode per title)

- FIFA World Cup: England vs France (QF), ITV1, 10 December 2022. 68.4% share. Average audience: 16.1 million.

- The State Funeral of HM Queen Elizabeth II (part 2), BBC One, 19 September 2022. 61.1% share. Average audience: 13.2 million.

- The Queen's Platinum Jubilee, BBC One, 4 June 2022. 66.2% share. Average audience: 13.2 million.

- I'm a Celebrity... Get Me Out of Here!, ITV1, 6 November 2022. 52.9% share. Average audience: 12.5 million.

- The Tourist, BBC One, 1 January 2022. 42.1% share. Average audience: 11.4 million.

- Happy New Year Live!, BBC One, 31 December 2022. 55.8% share. Average audience: 11.3 million.

- Women's Euro 2022: England vs Germany (F), BBC One, 31 July 2022. 64.1% share. Average audience: 11.2 million.

- Trigger Point, ITV1, 23 January 2022. 43.8% share. Average audience: 10.9 million.

- Strictly Come Dancing, BBC One, 17 December 2022. 55.0% share. Average audience: 10.7 million.

- The Thief, His Wife and The Canoe, ITV1, 17 April 2022. 41.9% share. Average audience: 10.1 million.

Radio continues to thrive despite the rise of music streaming

Live radio continues to have a wide reach, partly driven by some audiences shifting their listening online. Live radio is still the most popular form of audio, with 88% of adults tuning in for an average of 20 hours each week. And with radio listening continuing to shift online, smart speakers now account for a fifth of radio listening at home.

Post-lockdown havits prompt a drop in TV and video viewing

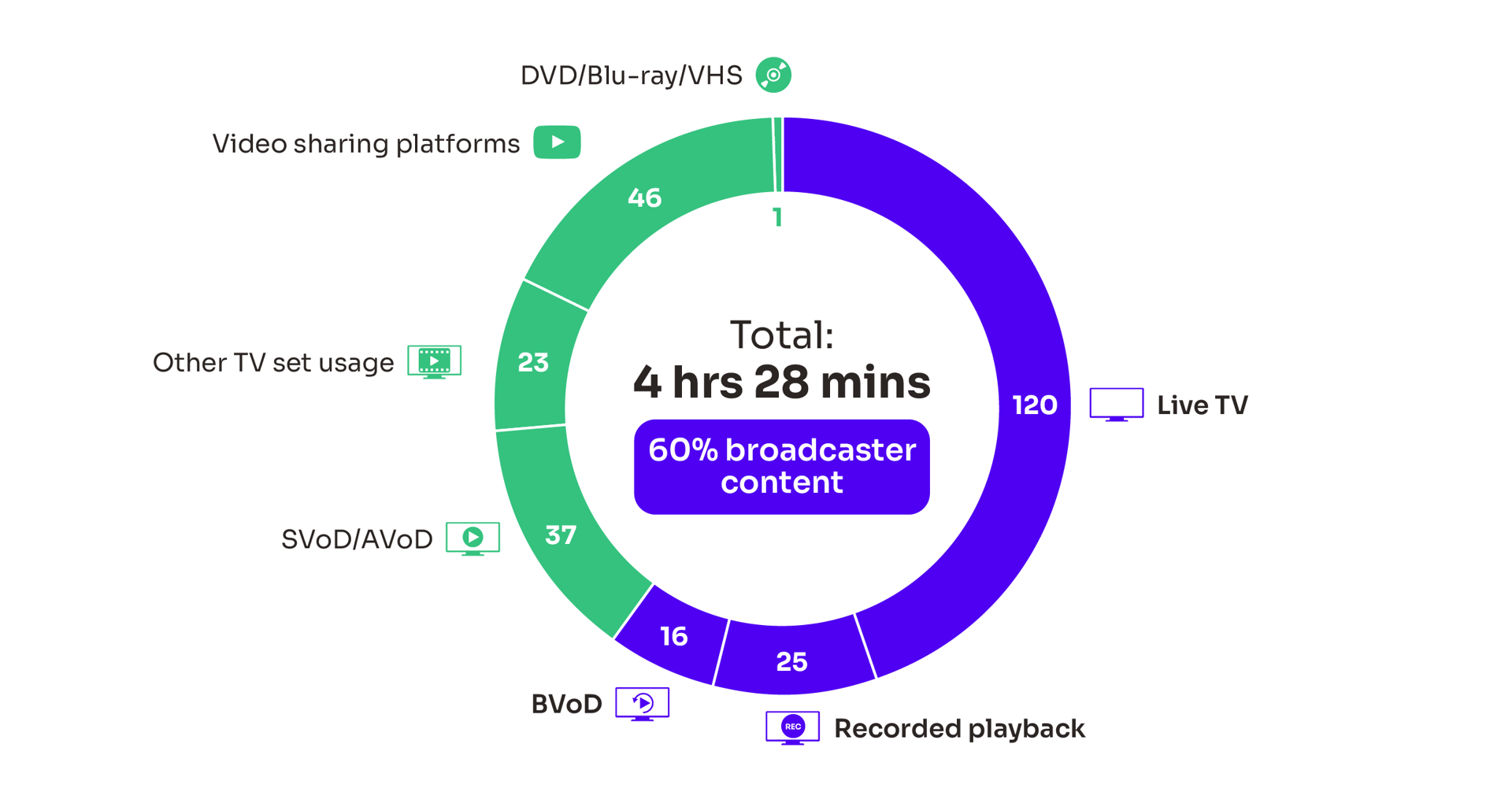

The average amount of time spent watching TV and video content across all devices in 2022 was 4 hours 28 minutes per person, per day.

We estimate that this was about 12% lower than in 2021, when Covid-19 restrictions may have meant people were spending more time at home watching content.

Streaming sign-ups stall due to competition and rising costs

Take-up of subscription video-on-demand services – which includes the likes of Netflix, Amazon Prime Video and Disney+ – stalled amid economic pressure on households, growing competition in the sector, and price rises introduced by the platforms. Following increased sign-ups to these services during the pandemic, when the number of UK households subscribing to at least one service reached 68%, that figure has since come down slightly and plateaued at about 66%, or 19 million households.

News and ‘how-to’ content are the most popular short-form videos

More than a third of online adults watch short-form video (videos shorter than ten minutes) daily, with younger audiences more likely to do so. YouTube is the most popular social platform for short-form video platform, followed by Facebook and Instagram.

Among adults who watched short-form content at least once a month, the most popular genre was ‘how-to’ videos (64%), followed by news (63%) and videos uploaded by the general public (59%).

Spend on recorded music continues to rise

People in the UK spent almost £2bn on recorded music in 2022, with subscriptions to online music services such as Spotify and Apple Music accounting for 83% of that total. Expenditure on physical formats fell by 4% year on year as the continued growth in vinyl (11%) wasn’t enough to offset the 17% decline in purchase of CDs. Meanwhile, the volume of cassettes continued to increase and grew by 5% to a total of 195,000 units (accounting for 1.1% of total physical album sales).

People in the UK spent almost

£2bnon recorded music in 2022

Spotify remains most popular platform for music streaming

While music streaming accounts for just a fifth of audio listening for adults, this rises to half of audio listening for young people. Spotify continues to be the most popular service for music streaming, while YouTube and Amazon also increased their reach to four in ten and a third of music streamers respectively.

Spotify, YouTube and BBC Sounds are the most popular services for podcasts, all reaching just over two-thirds of these listeners each week. The biggest year-on-year growth was for BBC Sounds, which went from reaching just over a fifth of online radio users in 2022 (21%) to more than a third (35%) in 2023.

Sports and drama benefit from increased investment

Several major sporting events, including those that made it into the top ten most viewed programmes, contributed to the highest volume of original sports programming by the public service broadcasters (PSBs) for a decade. This accounted for 10% of original content on PSB channels. In addition, the volume of original drama programming on PSB channels reached its highest level since 2016. This investment was despite the commercial public service broadcasters and digital multichannels seeing advertising revenues decline, partly driven by the downturn in the UK economy in the second half of 2022.